It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. That said, the current statutory profit is not always a good guide to a company’s underlying profitability. Today we’ll focus on whether this year’s statutory profits are a good guide to understanding Earthstone Energy (NYSE:ESTE).

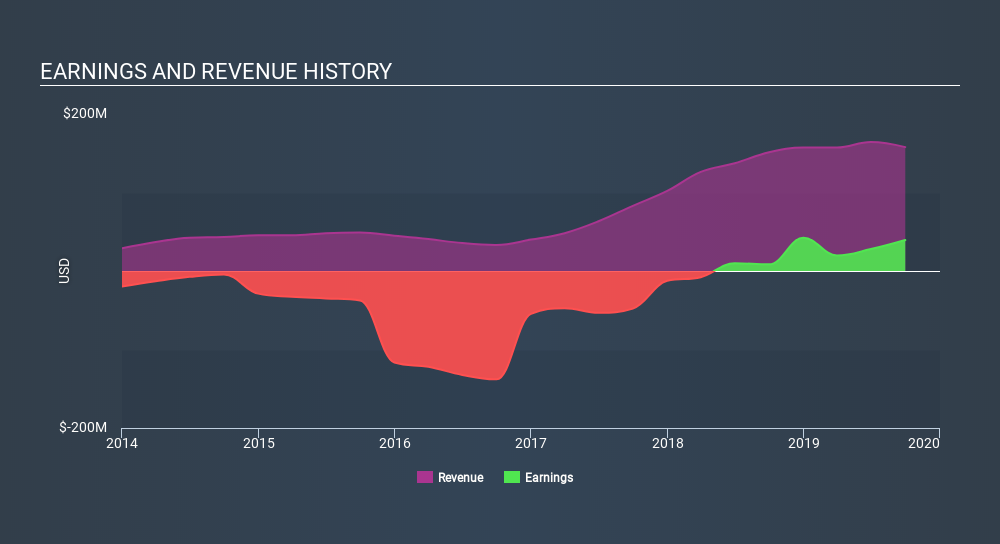

It’s good to see that over the last twelve months Earthstone Energy made a profit of US$39.5m on revenue of US$157.8m. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

Check out our latest analysis for Earthstone Energy

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. This article will discuss how unusual items have impacted Earthstone Energy’s most recent profit results. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

To properly understand Earthstone Energy’s profit results, we need to consider the US$17m expense attributed to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that’s hardly a surprise given these line items are considered unusual. If Earthstone Energy doesn’t see those unusual expenses repeat, then all else being equal we’d expect its profit to increase over the coming year.

Our Take On Earthstone Energy’s Profit Performance

Unusual items (expenses) detracted from Earthstone Energy’s earnings over the last year, but we might see an improvement next year. Based on this observation, we consider it likely that Earthstone Energy’s statutory profit actually understates its earnings potential! And on top of that, its earnings per share have grown at an extremely impressive rate over the last year. Of course, we’ve only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. Obviously, we love to consider the historical data to inform our opinion of a company. But it can be really valuable to consider what other analysts are forecasting. Luckily, you can check out what analysts are forecsting by clicking here.

Today we’ve zoomed in on a single data point to better understand the nature of Earthstone Energy’s profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to ‘follow the money’ and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

These great dividend stocks are beating your savings account

Not only have these stocks been reliable dividend payers for the last 10 years but with the yield over 3% they are also easily beating your savings account (let alone the possible capital gains). Click here to see them for FREE on Simply Wall St."profit" - Google News

January 04, 2020 at 08:38PM

https://ift.tt/2trRXo4

Does Earthstone Energy’s (NYSE:ESTE) Statutory Profit Adequately Reflect Its Underlying Profit? - Simply Wall St

"profit" - Google News

https://ift.tt/2sPbajb

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment