Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it’s not always clear whether statutory profits are a good guide, going forward. In this article, we’ll look at how useful this year’s statutory profit is, when analysing ams (VTX:AMS).

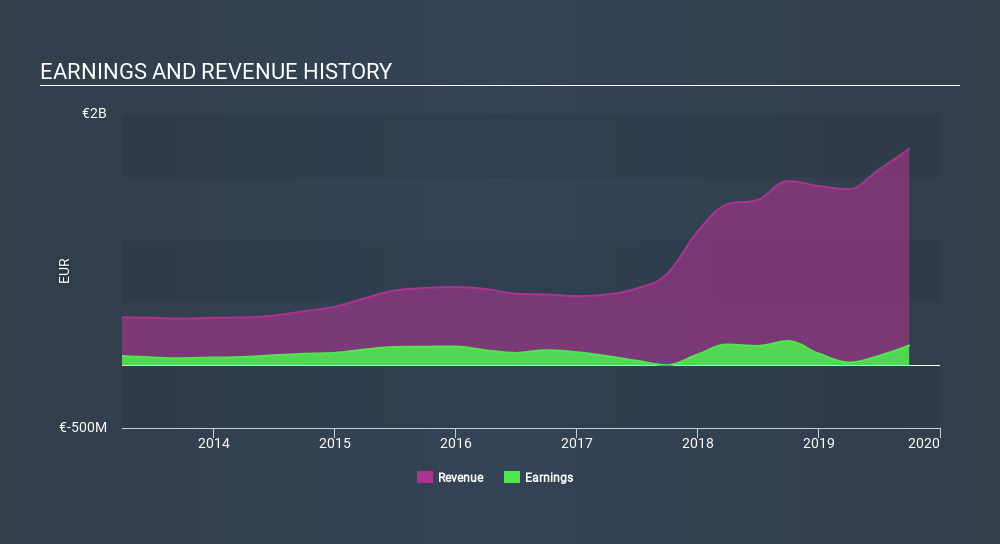

While ams was able to generate revenue of €1.72b in the last twelve months, we think its profit result of €156.6m was more important.

See our latest analysis for ams

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. As a result, today we’re going to take a closer look at ams’s cashflow, and unusual items, with a view to understanding what these might tell us about its statutory profit. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Examining Cashflow Against ams’s Earnings

Many investors haven’t heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company’s profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the ‘non-FCF profit ratio’.

Therefore, it’s actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it’s worth noting when a company has a relatively high accrual ratio. That’s because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to September 2019, ams recorded an accrual ratio of -0.12. That indicates that its free cash flow was a fair bit more than its statutory profit. To wit, it produced free cash flow of €463m during the period, dwarfing its reported profit of €156.6m. Notably, ams had negative free cash flow last year, so the €463m it produced this year was a welcome improvement.

However, that’s not all there is to consider. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part

How Do Unusual Items Influence Profit?

Surprisingly, given ams’s accrual ratio implied strong cash conversion, its paper profit was actually boosted by €48m in unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that’s as you’d expect, given these boosts are described as ‘unusual’. ams had a rather significant contribution from unusual items relative to its profit to September 2019. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On ams’s Profit Performance

In conclusion, ams’s accrual ratio suggests its statutory earnings are of good quality, but on the other hand the profits were boosted by unusual items. Having considered these factors, we’re tentatively of the view that ams’s statutory profit might overstate its underlying earnings. While it’s really important to consider how well a company’s statutory earnings represent its true earnings power, it’s also worth taking a look at what analysts are forecasting for the future. At Simply Wall St, we have analyst estimates which you can view by clicking here.

Our examination of ams has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

The easiest way to discover new investment ideas

Save hours of research when discovering your next investment with Simply Wall St. Looking for companies potentially undervalued based on their future cash flows? Or maybe you’re looking for sustainable dividend payers or high growth potential stocks. Customise your search to easily find new investment opportunities that match your investment goals. And the best thing about it? It’s FREE. Click here to learn more."profit" - Google News

January 02, 2020 at 01:27PM

https://ift.tt/39wUVs1

Does ams’s (VTX:AMS) Statutory Profit Adequately Reflect Its Underlying Profit? - Simply Wall St

"profit" - Google News

https://ift.tt/2sPbajb

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment