As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company’s underlying profitability. This article will consider whether Incyte‘s (NASDAQ:INCY) statutory profits are a good guide to its underlying earnings.

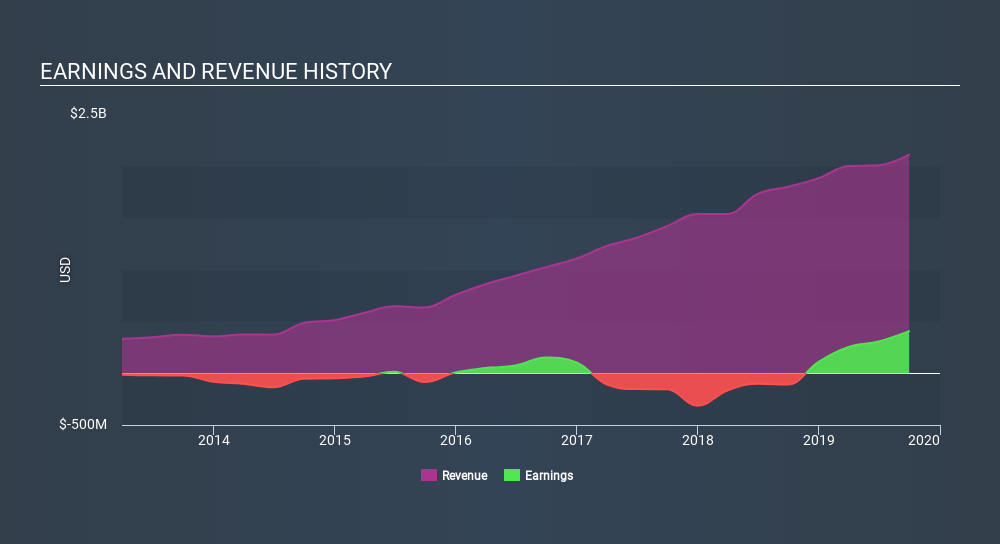

It’s good to see that over the last twelve months Incyte made a profit of US$405.0m on revenue of US$2.11b.

View our latest analysis for Incyte

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. So today we’ll look at what Incyte’s cashflow tells us about the quality of its earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Examining Cashflow Against Incyte’s Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company’s profit is not backed by free cashflow.

Therefore, it’s actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it’s not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That’s because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to September 2019, Incyte recorded an accrual ratio of -0.41. That implies it has very good cash conversion, and that its earnings in the last year actually significantly understate its free cash flow. Indeed, in the last twelve months it reported free cash flow of US$589m, well over the US$405.0m it reported in profit. Incyte’s free cash flow improved over the last year, which is generally good to see.

Our Take On Incyte’s Profit Performance

Happily for shareholders, Incyte produced plenty of free cash flow to back up its statutory profit numbers. Because of this, we think Incyte’s underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! And it’s also positive that the company showed enough improvement to book a profit this year, after losing money last year. Of course, we’ve only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. While it’s really important to consider how well a company’s statutory earnings represent its true earnings power, it’s also worth taking a look at what analysts are forecasting for the future. At Simply Wall St, we have analyst estimates which you can view by clicking here.

This note has only looked at a single factor that sheds light on the nature of Incyte’s profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

The easiest way to discover new investment ideas

Save hours of research when discovering your next investment with Simply Wall St. Looking for companies potentially undervalued based on their future cash flows? Or maybe you’re looking for sustainable dividend payers or high growth potential stocks. Customise your search to easily find new investment opportunities that match your investment goals. And the best thing about it? It’s FREE. Click here to learn more."profit" - Google News

January 02, 2020 at 01:36AM

https://ift.tt/2rHA2Js

We Think Incyte’s (NASDAQ:INCY) Statutory Profit Might Understate Its Earnings Potential - Simply Wall St

"profit" - Google News

https://ift.tt/2sPbajb

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment