As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company’s underlying profitability. Today we’ll focus on whether this year’s statutory profits are a good guide to understanding Welcron (KOSDAQ:065950).

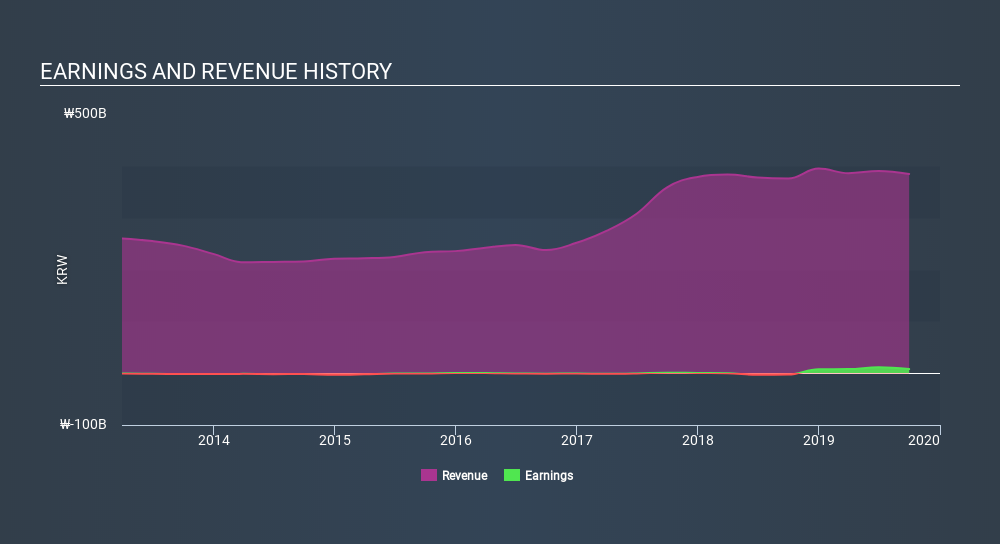

It’s good to see that over the last twelve months Welcron made a profit of ₩7.96b on revenue of ₩384.4b. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

Check out our latest analysis for Welcron

Importantly, statutory profits are not always the best tool for understanding a company’s true earnings power, so it’s well worth examining profits in a little more detail. Therefore, today we will consider the nature of Welcron’s statutory earnings with reference to its dilution of shareholders and the impact of unusual items. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Welcron.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Welcron issued 6.9% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Welcron’s EPS by clicking here.

A Look At The Impact Of Welcron’s Dilution on Its Earnings Per Share (EPS).

Three years ago, Welcron lost money. And even focusing only on the last twelve months, we don’t have a meaningful growth rate because it made a loss a year ago, too. What we do know is that while it’s great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn’t needed to issue shares. So you can see that the dilution has had a bit of an impact on shareholders.Therefore, the dilution is having a noteworthy influence on shareholder returnsAnd so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Welcron’s earnings per share can increase, then the share price should too. But on the other hand, we’d be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company’s share price might grow.

How Do Unusual Items Influence Profit?

On top of the dilution, we should also consider the ₩4.0b impact of unusual items in the last year, which had the effect of suppressing profit. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that’s exactly what the accounting terminology implies. In the twelve months to September 2019, Welcron had a big unusual items expense. All else being equal, this would likely have the effect of making the statutory profit look worse than its underlying earnings power.

Our Take On Welcron’s Profit Performance

Welcron suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Considering all the aforementioned, we’d venture that Welcron’s profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. While earnings are important, another area to consider is the balance sheet. You can seeour latest analysis on Welcron’s balance sheet health here.

In this article we’ve looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to ‘follow the money’ and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

The easiest way to discover new investment ideas

Save hours of research when discovering your next investment with Simply Wall St. Looking for companies potentially undervalued based on their future cash flows? Or maybe you’re looking for sustainable dividend payers or high growth potential stocks. Customise your search to easily find new investment opportunities that match your investment goals. And the best thing about it? It’s FREE. Click here to learn more."profit" - Google News

January 06, 2020 at 12:11PM

https://ift.tt/35rkLuf

Does Welcron’s (KOSDAQ:065950) Statutory Profit Adequately Reflect Its Underlying Profit? - Simply Wall St

"profit" - Google News

https://ift.tt/2sPbajb

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment