Statistically speaking it is less risky to invest in profitable companies than in unprofitable ones. That said, the current statutory profit is not always a good guide to a company’s underlying profitability. This article will consider whether Allied Digital Services‘s (NSE:ADSL) statutory profits are a good guide to its underlying earnings.

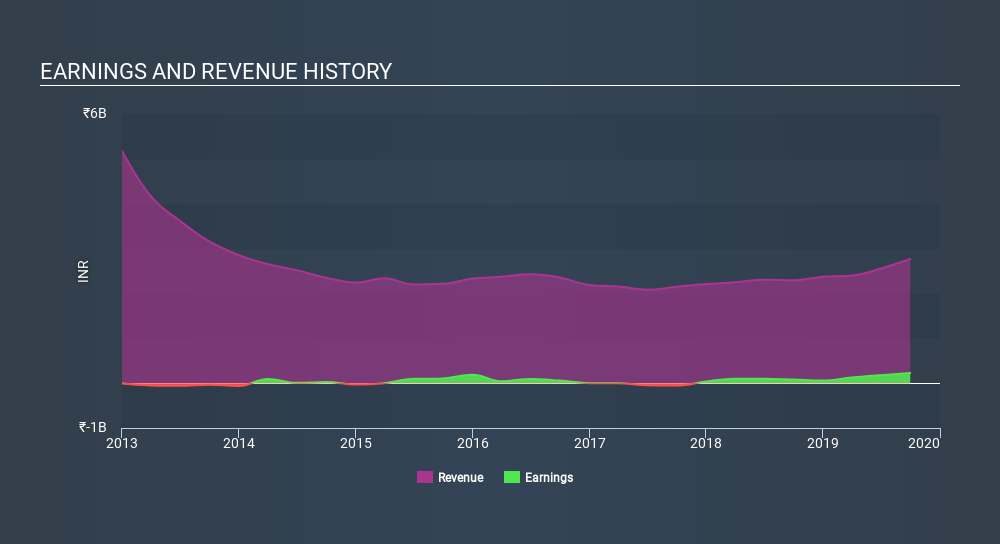

It’s good to see that over the last twelve months Allied Digital Services made a profit of ₹225.5m on revenue of ₹2.77b.

See our latest analysis for Allied Digital Services

Not all profits are equal, and we can learn more about the nature of a company’s past profitability by diving deeper into the financial statements. This article will focus on the impact unusual items have had on Allied Digital Services’s statutory earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Allied Digital Services.

The Impact Of Unusual Items On Profit

While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that’s exactly what the accounting terminology implies. If Allied Digital Services doesn’t see that contribution repeat, then all else being equal we’d expect its profit to drop over the current year.

Our Take On Allied Digital Services’s Profit Performance

Arguably, Allied Digital Services’s statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that Allied Digital Services’s true underlying earnings power is actually less than its statutory profit. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. At the end of the day, it’s essential to consider more than just the factors above, if you want to understand the company properly. While earnings are important, another area to consider is the balance sheet. You can seeour latest analysis on Allied Digital Services’s balance sheet health here.

Today we’ve zoomed in on a single data point to better understand the nature of Allied Digital Services’s profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

These great dividend stocks are beating your savings account

Not only have these stocks been reliable dividend payers for the last 10 years but with the yield over 3% they are also easily beating your savings account (let alone the possible capital gains). Click here to see them for FREE on Simply Wall St."profit" - Google News

December 31, 2019 at 07:33AM

https://ift.tt/2SB3SdQ

Does Allied Digital Services’s (NSE:ADSL) Statutory Profit Adequately Reflect Its Underlying Profit? - Simply Wall St

"profit" - Google News

https://ift.tt/2sPbajb

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment